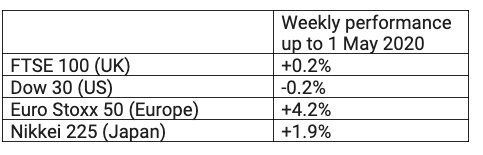

Last week was a tale of two halves for global equity markets. After a strong first part to the week which saw the FTSE 100 index break through the 6,000 barrier for the first time in eight weeks, most global equity markets fell back sharply on Thursday and Friday as a result of weak economic data, Royal Dutch Shell announcing their first cut in the dividend since World War Two and Donald Trump restarting the trade war rhetoric with China.

In terms of £ Sterling, it closed the week (to 1 May), at 1.25 US Dollars, which was 1.1% higher than the figure at the end of the previous week (24 April).

Against the Euro, £ Sterling closed on 1 May at 1.14 Euros, which was 0.4% lower than the closing figure on 24 April.

Inflation, as measured by the Consumer Prices Index including owner occupiers’ housing costs (CPIH was 1.5% in March 2020 (this is March’s data which is reported in April). This was down from 1.7% in the previous month. The 12-month rate for the Consumer Prices Index (CPI) rate which excludes owner occupied housing costs and council tax was also 1.5% in March, also down from 1.7% in February.

There were no further changes to the Bank of England base rate last week following the two previous cuts in March. The current rate remains at 0.1%.